North Carolina Sales Tax Rates By County 2025

BlogNorth Carolina Sales Tax Rates By County 2025. A new law means more than 130 towns and counties in north carolina could miss out on sales tax revenue due to missing audits. This is the total of state and county sales tax rates.

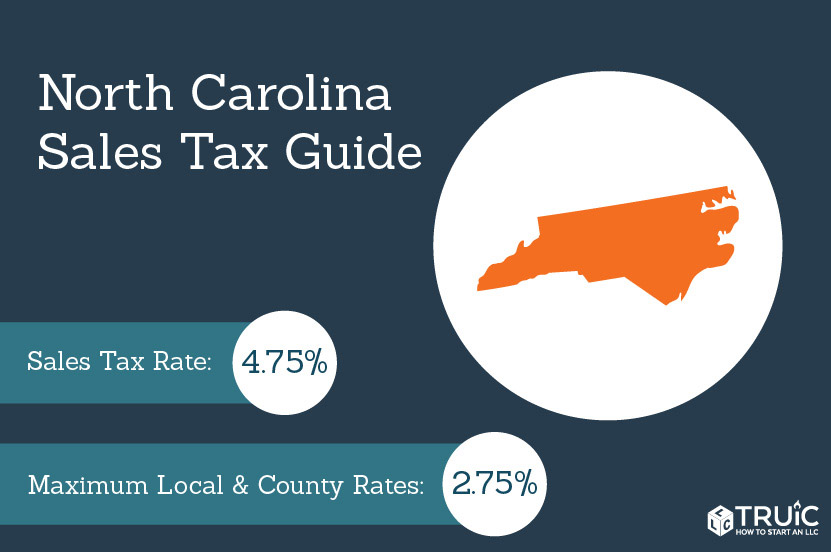

Ultimate North Carolina Sales Tax Guide Zamp, Download all north carolina sales tax rates by zip code. The north carolina sales tax rate is 4.75% as of 2025, with some cities and counties adding a local sales tax on top of the nc state sales tax.

North Carolina Sales Tax Small Business Guide TRUiC, The north carolina state sales tax rate is. This interactive sales tax map map of north carolina shows how local sales tax rates vary across north carolina's 100 counties.

North Carolina Sales Tax Calculator Step By Step Business, The north carolina department of revenue has published updated sales and use tax bulletins as well as tax bulletins for six other miscellaneous tax schedules. Use our calculator to determine your exact sales tax rate.

North Carolina Sales Tax Calculator State, County & Local Rates, Exact tax amount may vary for different items. Components of the 6.75% davie county sales tax.

Printable Sales Tax Chart Printable World Holiday, Exact tax amount may vary for different items. North carolina sales and use tax rates in 2025 range from 4.75% to 7.5% depending on location.

North Carolina Sales Tax Guide for Businesses, Download all north carolina sales tax rates by zip code. The state sales tax rate in north carolina is 4.75%, but you can customize this table as needed to reflect your applicable local sales tax rate.

Sales Tax by State Here’s How Much You’re Really Paying Sales tax, 2025 north carolina sales tax changes. North carolina has a statewide sales tax of 4.75%.

U.S. Sales Tax by State [1484×1419] MapPorn, Look up 2025 sales tax rates for gastonia, north carolina, and surrounding areas. Every 2025 combined rates mentioned above are the results of north carolina state rate (4.75%), the county rate (2% to 2.25%), and in some case, special rate (0% to 0.5%).

Tax rates for the 2025 year of assessment Just One Lap, The minimum combined 2025 sales tax rate for richmond county, north carolina is. This interactive sales tax map map of north carolina shows how local sales tax rates vary across north carolina's 100 counties.

North Carolina Automobile Sales Tax Rate brittasnaildesign, You can download the north carolina sales tax rates database from our partners. Vance county is on the list put.

![U.S. Sales Tax by State [1484x1419] MapPorn](https://external-preview.redd.it/t9sLze7hV6ZUinIl1h1wA8Vg4oASGxodMFiNWhYfjYE.png?auto=webp&s=08cfd4239c6068d48a2557b63d1d8404215a5da7)

The five states with the highest average combined state and local sales tax rates are louisiana (9.56 percent), tennessee (9.55 percent), arkansas (9.45 percent),.