Due Date For Texas Franchise Tax Return 2025

BlogDue Date For Texas Franchise Tax Return 2025. For those who file last minute, the irs will consider your paper return on time. The texas comptroller of public.

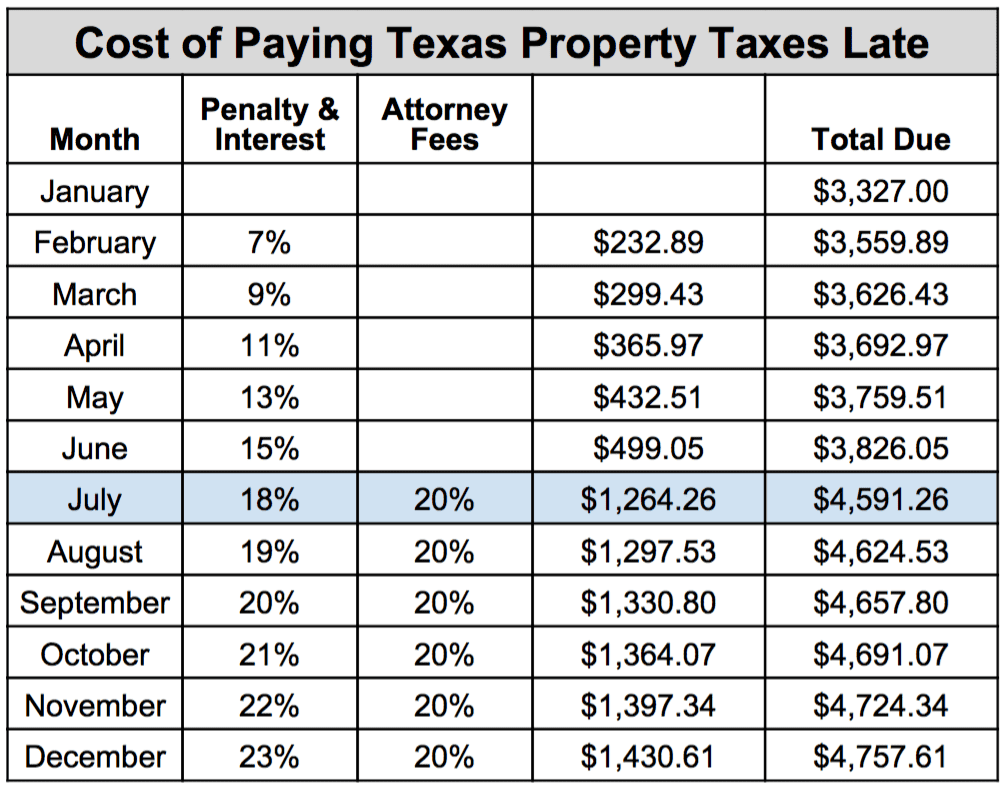

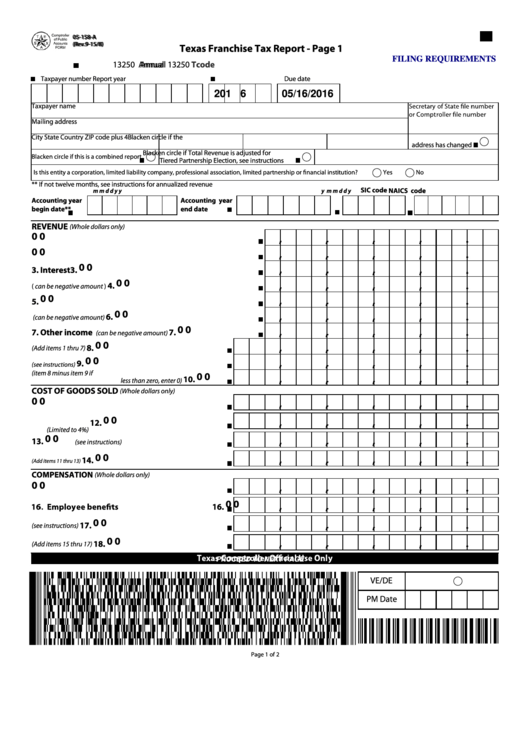

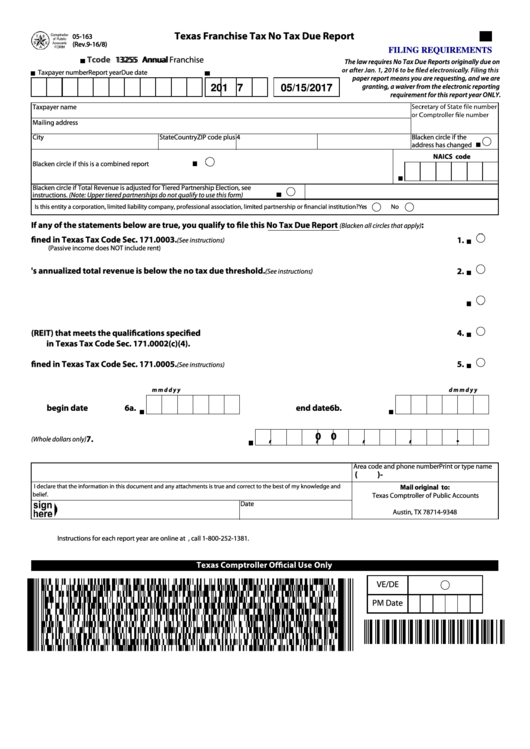

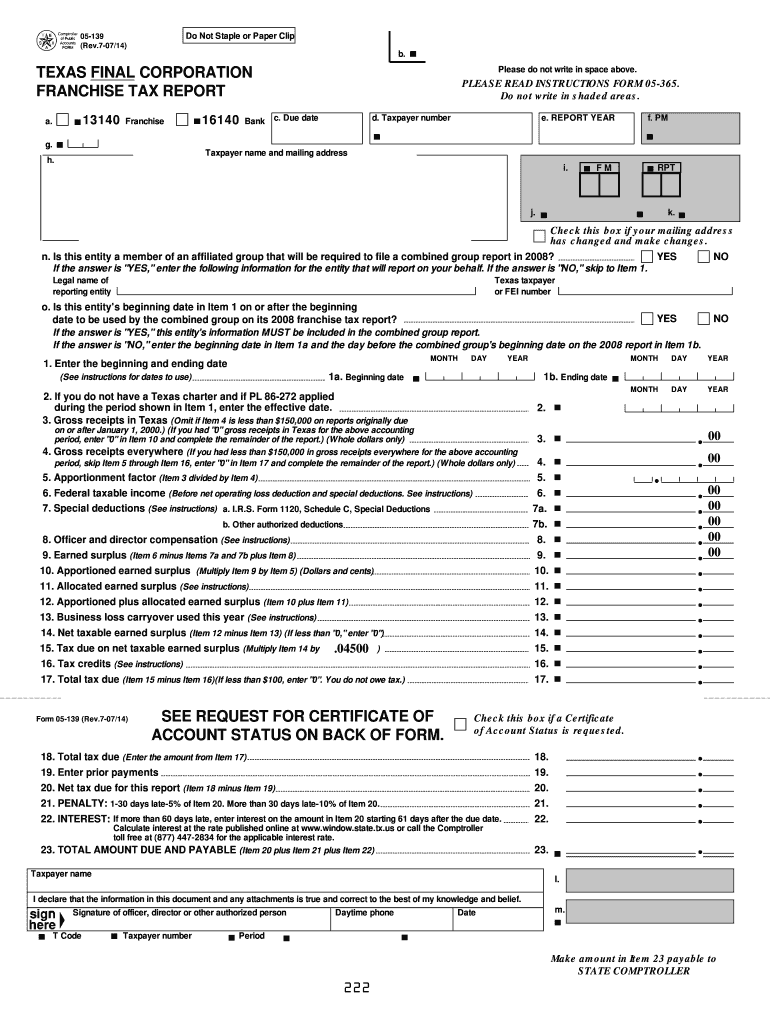

This has often been overlooked by business owners, resulting in a $50 penalty for a report filed after the due date. Generating texas franchise forms in proseries.

How To File Franchise Tax Report For State Of Texas, The last day to file your 2025 taxes is april 15, 2025. The texas comptroller of public.

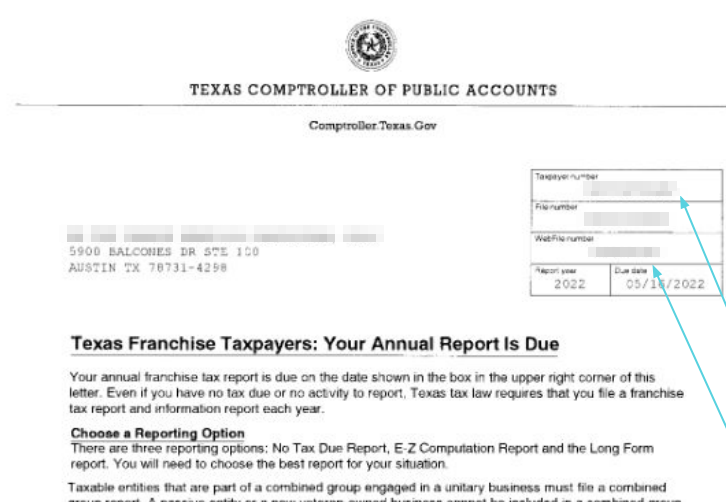

How To Calculate Revenue For Texas Franchise Tax, If you are a business owner in texas, recent changes in the franchise tax law will affect your filing obligations. (if may 15th falls on a weekend, the due date will be the following business day.) the.

Texas Franchise Tax, How difficult is it to program a no tax due texas franchise tax form? Texas annual report is to be filed for any fiscal year federal return ending in.

Top 17 Texas Franchise Tax Forms And Templates free to download in PDF, This has often been overlooked by business owners, resulting in a $50 penalty for a report filed after the due date. Reports that are due on or after january 1 st ,2025 and are below.

Submit Your Texas Franchise Filings or be Subject to Texas Tax Code 711, If you are a business owner in texas, recent changes in the franchise tax law will affect your filing obligations. Federal income tax returns are due april 15.

What Is The Texas State Franchise Tax, Texas is one of a small group of states that do not impose a state income tax, so this means there is one less deadline to. The deadline for taxpayers to file a 2025 tax return and pay any tax owed is monday, april 15, 2025.

Franchise Tax Returns and Public Information Report (PIR) filing in, It is not due until may 15th. For those who file last minute, the irs will consider your paper return on time.

State Corporate Tax Rates and Brackets Tax Foundation, How difficult is it to program a no tax due texas franchise tax form? Federal income tax returns are due april 15.

Texas Franchise Tax Instructions 20072024 Form Fill Out and Sign, Texas is one of a small group of states that do not impose a state income tax, so this means there is one less deadline to. You may request to extend this deadline to nov.

How to File Texas Franchise Tax A Complete DIY WalkThrough, For eft taxpayers—who paid a tax of $10,000 or more in any preceding year—the extended due date is august 15, at which time they need to file a second. The standard penalty is 5% of any tax due for every month.